A favorable variance indicates that the variance or difference between the budgeted and actual amounts was good or favorable for the company’s profits. In other words, this variance will be one reason why the amount of the company’s actual profits will be better than the budgeted profits. Watch this video presenting an instructor walking through the steps involved in calculating direct labor variances to learn more. When it comes to variances, there are a few key factors that can make them either favorable or unfavorable. A variance that is more severe is typically going to be seen as more unfavorable than one that is less severe.

Companies that fail to meet their earnings forecasts essentially have an unfavorable variance within their company–whether it be from higher costs, lower revenue, or lower sales. The total direct labor variance is also found by combining the direct labor rate variance and the direct labor time variance. By showing the total direct labor variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. Because of the cost principle, the financial statements for DenimWorks report the company’s actual cost. In other words, the balance sheet will report the standard cost of $10,000 plus the price variance of $3,500.

- A company has a greater ability to measure what it wants to improve on the more these areas it is broken in.

- Business budgets are usually forecasted by management based on future predictions.

- In general, the intent of an unfavorable variance is to highlight a potential problem that may negatively impact profits, which is then corrected.

- A budget is a forecast of revenue and expenses, including fixed costs as well as variable costs.

Unfavorable variance, in finance and business, is a pivotal concept used for budgeting, planning, and performance evaluation. Unfavorable variance occurs when actual costs are higher than the budgeted or standard costs, or when actual revenue is less than the projected revenue. It serves as an early warning system, enabling managers to promptly identify and address issues that cause shortcomings in achieving planned objectives.

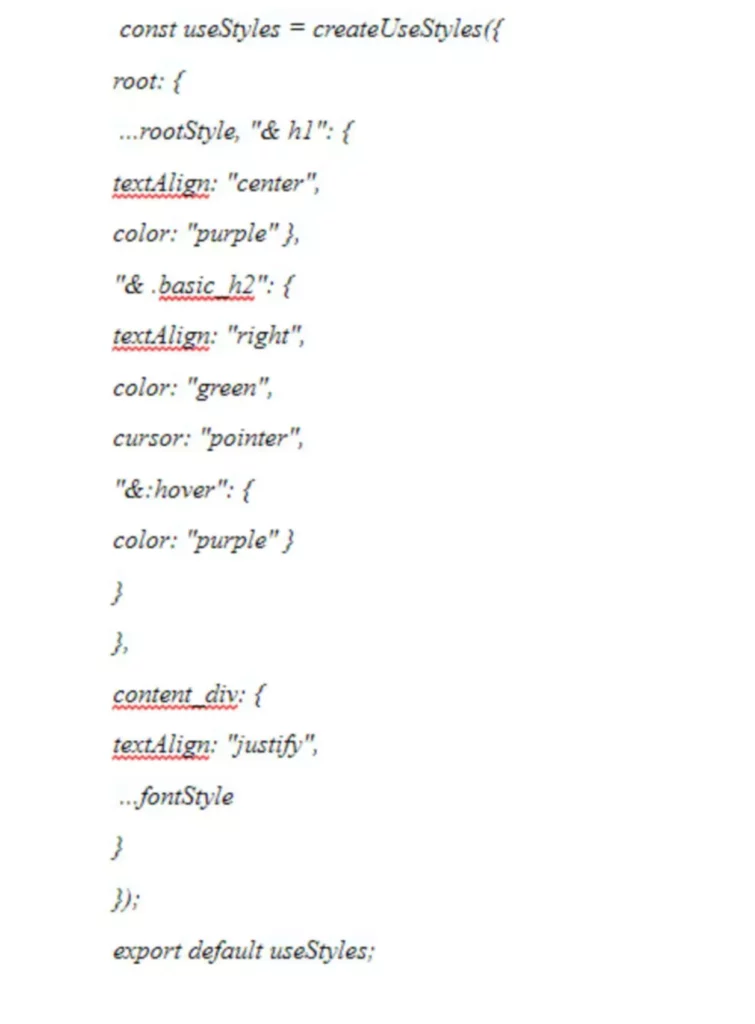

However, this article’ll discuss COGS variances (i.e., variances to costs of goods sold) versus the yearly budget. The usage variance is calculated by multiplying the GL cost of each component by the discrepancy between the actual quantity issued and the standard quantity needed. Businesses create sales budgets that predict how many new customers will buy new goods and services from their sales team in the upcoming months. From there, businesses can calculate the revenue that will be made as well as the expenses required to make those sales and provide those goods and services.

A company has a greater ability to measure what it wants to improve on the more these areas it is broken in. How do you create a good work order cost variance report if accurate work order structures, time standards, and labor and material reporting are required? Typically, variance analysis involves comparing numerous periods or benchmarks.

BREAKING DOWN Unfavorable Variance

If an unfavorable variance exceeds the minimum, then it is reported to managers, who then take action to correct whatever the underlying problem may be. The purchasing staff sets a standard purchase price for a widget of $2.00 per unit, which it can only attain if the company buys in volumes of 10,000 units. A separate initiative to reduce inventory levels calls for purchases in quantities of 1,000 units.

- This might happen when an invoice has not been received or a payment was made earlier or later than expected.

- For example, if sales were budgeted to be $200,000 for a period but were actually $180,000, there would be an unfavorable (or negative) variance of $20,000, or 10%.

- In this case, the actual hours worked are 0.05 per box, the standard hours are 0.10 per box, and the standard rate per hour is $8.00.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Further, some of the finished aprons don’t pass the final inspection due to occasional defects not detected as the aprons were made. Unfavorable variances are labeled as such or expressed as a negative number. This variance would be presented on paper as either $200 unfavorable, -$200 or ($200). Uncontrollable expenses most likely occur in the marketplace when a company’s supply is greater than their projected demand from customers.

The variance is unfavorable because having less actual revenues than the budgeted amount was not good for the company’s profits. It will also be one reason for the company’s actual profits being worse than the budgeted profits. The two primary types of unfavorable variance include cost variance and revenue variance. Cost variance is unfavorable when actual costs exceed the budgeted costs, while revenue variance is unfavorable when actual revenues fall short of budgeted revenues. In this case, two elements are contributing to the unfavorable outcome. Connie’s Candy paid $1.50 per hour more for labor than expected and used 0.10 hours more than expected to make one box of candy.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected. Either may be good or bad, as these variances are based on a budgeted amount. Often budget variances can be eliminated by analyzing your expenses and allocating an expensed item to another budget line. Let’s say you have a negative paper supply budget variance of $2,000 and a positive ink budget variance of $3,000. Combining those two lines under a supply line item can ensure that you have a favorable variance of $1,000 in your budget plan.

Unfavorable Expense Variance

Here are a few questions you can ask yourself when investigating unfavorable variances. Budget variance is the difference between expenses and revenue in your financial budget and the actual costs. An unfavorable variance is when costs are greater than what has been budgeted. The unfavorable variance concept is of particular use in those organizations that adhere rigidly to a budget. In these companies, a financial analyst reports variances that are unfavorable in relation to the budget. Managers are then responsible for bringing the variance back into conformity with the budget.

Company

A management team could analyze whether to bring in temporary workers to help boost sales efforts. Management could also offer target-based financial incentives to salespeople or create more robust marketing campaigns to generate buzz in the marketplace for their product or service. An unfavorable variance occurs when the cost to produce something is greater than the budgeted amount. A favorable variance may indicate to the management of a company that its business is doing well and operating efficiently. As a company grows, it may have learned ways to produce more without a need to increase its expenses, resulting in a higher revenue stream. However, a favorable variance may indicate that production expectations were not realistic in the first place, which is more likely if the company is new.

Corporations value budgets because they enable them to plan for the future by estimating the expected revenue from sales. As a result, businesses can budget how much money to spend on various initiatives or internal investments. When revenues are lower than accounting for consignment expected, or expenses are higher than expected, the variance is unfavorable. For example, if the expected price of raw materials was $7 a pound but the company was forced to pay $9 a pound, the $200 variance would be unfavorable instead of favorable.

Learn How Standard Deviation Is Determined by Using Variance

In other words, the business hasn’t made as much money as anticipated. It indicates that the net income was less than expected for the period. The unfavorable variance may result from lower revenue and higher expenses or both. You almost certainly are producing either favorable or unfavorable manufacturing variances.

Unfavorable variance definition

Consequently, a large favorable variance may have been manufactured by setting an excessively low budget or standard. A volume variance will result from selling more of any or all products than anticipated, which will impact the cost as a whole. As easy as this calculation may seem, you’ll need to take a few steps to separate the mix component to truly see volume variance, as we’ll see when we talk more about volume variance analysis. A company’s management team must thoroughly investigate and determine the root of an unfavorable variance. The company can make the necessary adjustments and resume its plan’s course once the root cause has been identified.

If the actual hours worked are less than the standard hours at the actual production output level, the variance will be a favorable variance. A favorable outcome means you used fewer hours than anticipated to make the actual number of production units. If, however, the actual hours worked are greater than the standard hours at the actual production output level, the variance will be unfavorable.